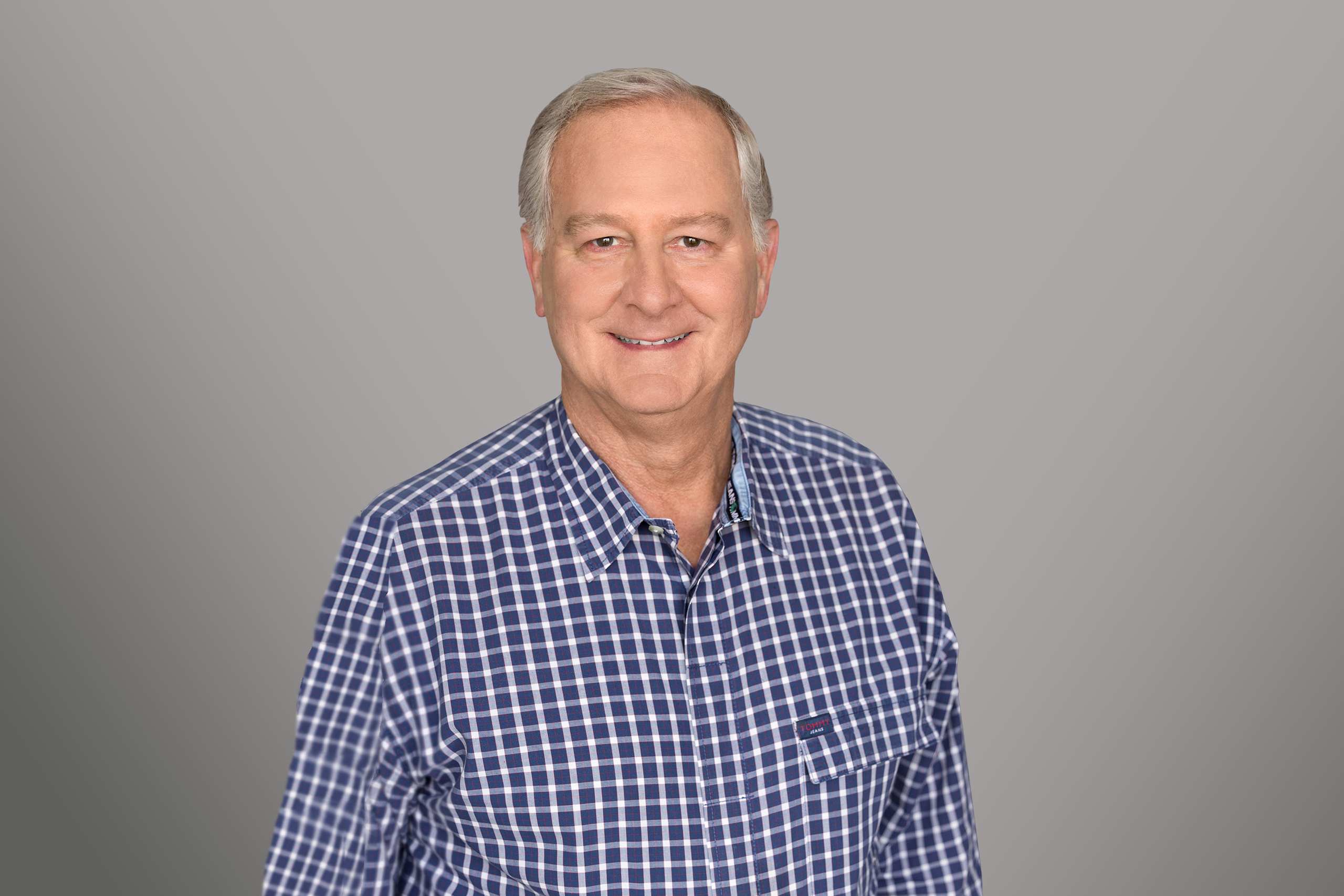

Douglas L. Youmans

Douglas Youmans, with over 40 years of experience, practices in business, estate, real estate, and tax planning and controversy work. His practice is designed to offer comprehensive legal solutions, catering to the multifaceted needs of individuals, executives, and business owners navigating the legal system. This integrated approach ensures clients receive thorough legal advice, covering various aspects of their professional and personal legal requirements.

In addition to directly serving clients, Douglas offers legal services to primary attorneys, accountants, financial advisors, and other representatives. His proactive legal risk management strategies are a cornerstone of his practice, aiming to foresee and mitigate legal issues before they arise, thus providing clients with peace of mind and safeguarding their interests.

Education

- J.D., University of the Pacific, McGeorge School of Law

- M.B.A., Taxation, Golden Gate University

- B.A., Temple University, magna cum laude

Areas Of Practice

OTHER EXPERIENCE

- Tax Planning and Controversy Resolution

- Business Planning, including Mergers & Acquisitions

- Trust Administration

Awards and Honors

- AV Preeminent 5.0 Peer Review Rated by Martindale-Hubbell

- Recipient of the 2015 V Judson Klein award, which the Tax Section of the California State Bar awards to a distinguished attorney, based on their achievements and service to the Bar

- Named as a Northern California Super Lawyer multiple years since 2014

PROFESSIONAL AND COMMUNITY ACTIVITIES

- Member, State Bar of California

- Chair, Executive Committee of the Taxation Section of the State Bar of California, 2012-2013

- Chair of the Corporations and other Business Entities Committee of the State Bar of California Taxation Section

- Member, State Bar of California Probate, Practice Management and Tax Sections

- Member, American Bar Association

- Member, Sacramento County Bar Association

- Member, Society of California Accountants (SCA)

- Member, California Society of CPAs (CALCPA)

- Member, American Institute of CPAs (AICPA)

- Author and paper presenter for several of the California State Bar Taxation Section’s Annual delegations to Washington D.C.

- Charter Member and Former Chair, Internal Revenue Service Sacramento District Practitioners Liaison Committee

- Charter Member, Franchise Tax Board Advisory Group

- Adjunct Professor, Golden Gate University

- Adjunct Professor, Sacramento State University

Admissions

- California State Bar (Certified Specialist, Taxation Law)

- U.S. Supreme Court

- U.S. Courts of Appeal for the Seventh and Ninth Circuits

- U.S. District Court, Eastern District of California

- U.S. Tax Court